GigaCloud Technology: The Small-Cap Stock Poised for Explosive Growth in 2025 and Beyond

In the bustling landscape of the Indian stock market, identifying undervalued opportunities is key to achieving significant returns. GigaCloud Technology Inc. (GCT) is emerging as a compelling small-cap contender, recently recognized as 'America's Most Successful Small Cap Company 2025'. While relatively unknown to many Indian investors, GCT's unique business model and impressive growth trajectory suggest it could be a hidden gem ripe for discovery. This article delves into the core of GCT's operations, explores its potential, and examines why it might be a contrarian investment worth considering.

What is GigaCloud Technology?

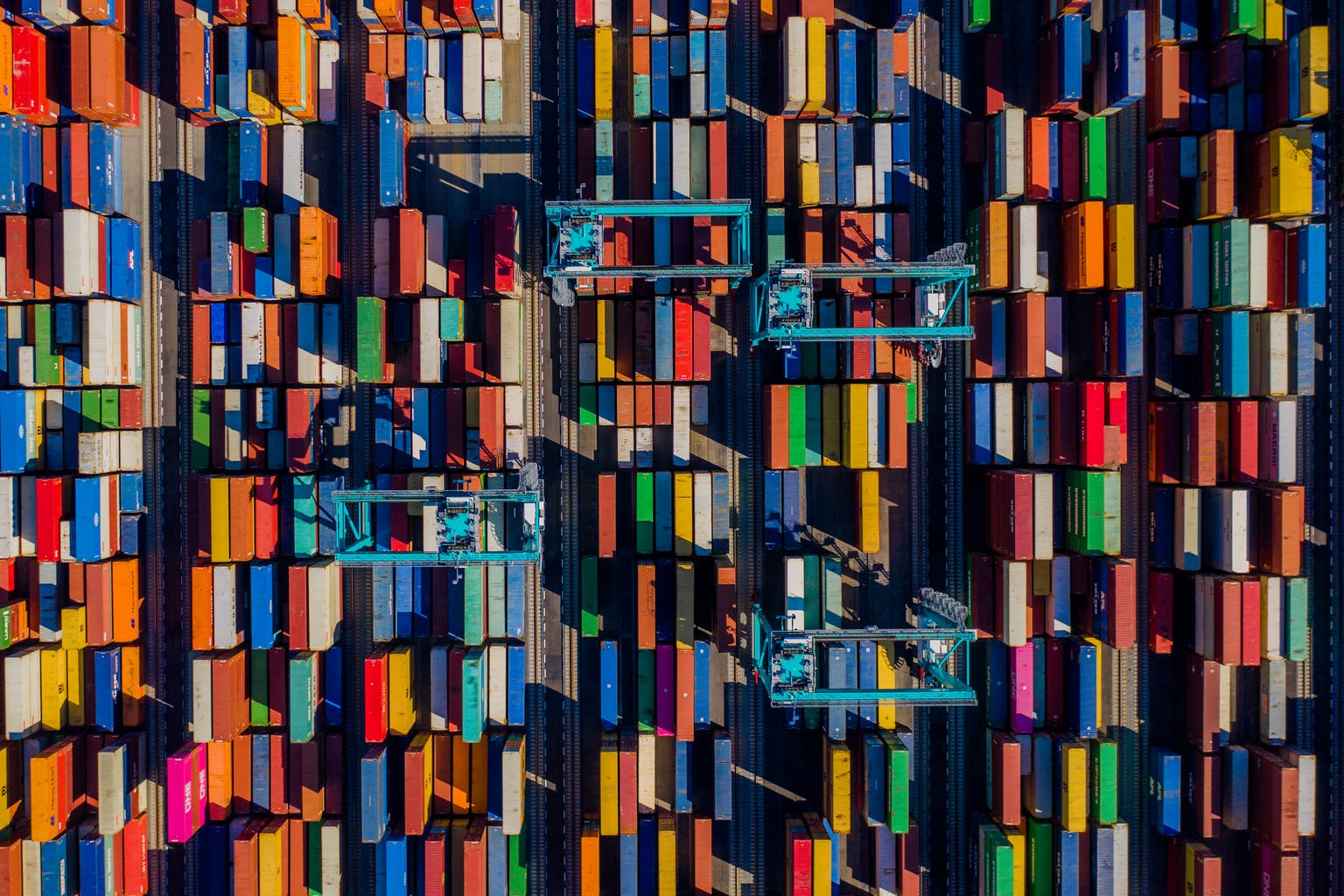

GigaCloud Technology operates within the rapidly expanding logistics and transportation sector, specifically focusing on providing technology-driven solutions for freight management. Their core offering revolves around a sophisticated cloud-based platform that connects shippers and carriers, streamlining the entire process from load posting to payment. Unlike traditional brokerage models, GigaCloud leverages technology to optimize efficiency, reduce costs, and enhance visibility for both parties.

Why the 'Most Successful Small Cap Company 2025' Recognition?

The accolade isn't just a label; it's a reflection of GCT's remarkable performance and future prospects. Several factors contribute to this recognition:

- Scalable Business Model: The cloud-based platform allows for rapid scaling with minimal incremental costs, leading to high operating leverage.

- Strong Revenue Growth: GCT has consistently demonstrated impressive revenue growth, driven by increasing adoption of their platform and expanding service offerings.

- Focus on Technology: Their commitment to technological innovation provides a competitive edge in a traditionally fragmented and inefficient industry.

- Strategic Partnerships: GCT has forged strategic partnerships with key players in the logistics ecosystem, further solidifying their position.

- Data-Driven Optimization: The platform generates valuable data insights that allow shippers and carriers to optimize their operations and improve profitability.

GCT Stock Prospects: Why Indian Investors Should Pay Attention

While GCT is an American company, its potential impact on the global logistics landscape, and consequently, the opportunities for Indian investors, are significant. Here's why GCT stock warrants consideration:

- Global Logistics Trend: The global logistics market is undergoing a digital transformation, and GCT is at the forefront of this trend.

- Potential for Cross-Border Collaboration: GCT's platform could facilitate increased trade and collaboration between Indian businesses and international partners.

- Diversification Benefits: Investing in GCT offers diversification benefits for Indian investors seeking exposure to the US technology market.

- Contrarian Opportunity: As a relatively unknown small-cap, GCT presents a contrarian investment opportunity with significant upside potential.

Risks to Consider

Like any investment, GCT carries certain risks. These include:

- Competition: The logistics technology market is becoming increasingly competitive.

- Economic Downturn: A slowdown in the global economy could impact demand for logistics services.

- Regulatory Changes: Changes in transportation regulations could affect GCT's operations.

- Cybersecurity Risks: As a technology company, GCT is vulnerable to cybersecurity threats.

Conclusion

GigaCloud Technology Inc. presents a compelling investment opportunity for Indian investors seeking exposure to a rapidly growing logistics technology company. While risks exist, the company's scalable business model, strong revenue growth, and commitment to innovation position it for continued success. As 'America's Most Successful Small Cap Company 2025,' GCT is a name that deserves closer attention. Further research and due diligence are, of course, recommended before making any investment decisions. Consider consulting with a financial advisor to determine if GCT aligns with your investment goals and risk tolerance.