Amkor Technology (AMKR): Navigating Uncertainty – Is This a Hold or a Potential Fall?

Amkor Technology (AMKR) has shown remarkable resilience, bouncing back from a significant downturn. However, the semiconductor industry remains fraught with challenges, and shifting demand patterns could trigger another dip in the stock price. This analysis delves into Amkor's current position, examining the factors driving its performance and assessing whether AMKR stock warrants a 'hold' rating or signals a potential correction. We'll explore the headwinds, demand trends, and key catalysts that investors need to consider.

The Recent Rebound: A Look at Amkor's Performance

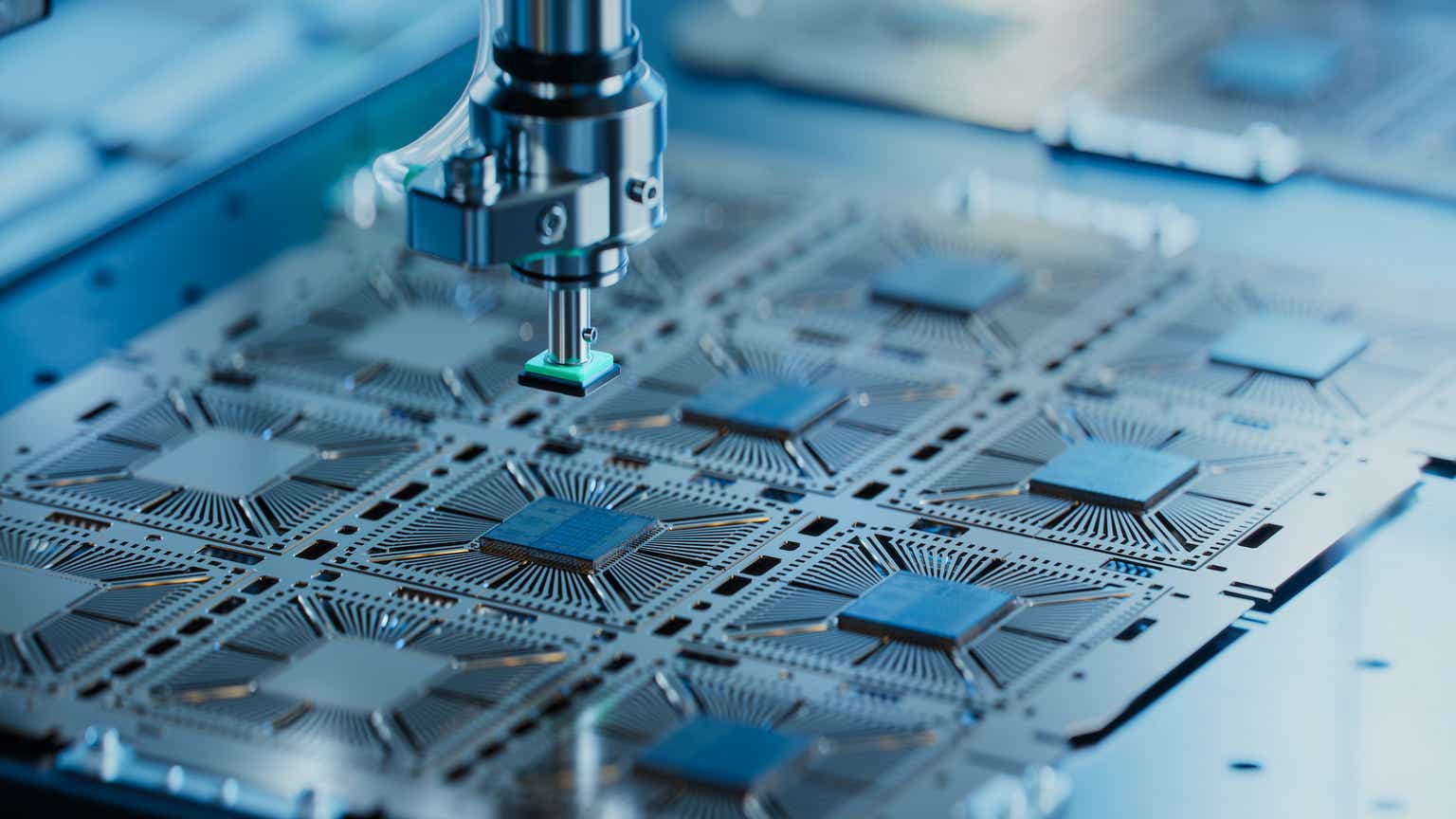

After experiencing a considerable decline, Amkor Technology demonstrated a strong recovery, driven by several factors. The easing of supply chain bottlenecks, coupled with a gradual recovery in certain end markets, contributed to this positive momentum. Amkor’s focus on packaging and testing services for a diverse range of semiconductor companies – including those involved in automotive, industrial, and communications technologies – has provided some insulation from the volatility affecting chip manufacturers themselves. Their strategic partnerships and expanding global footprint have also played a crucial role.

Headwinds on the Horizon: Challenges Facing Amkor

Despite the recent gains, Amkor isn't immune to the broader economic uncertainties. Several headwinds loom on the horizon. Firstly, the cyclical nature of the semiconductor industry means that demand can fluctuate significantly. The current macroeconomic environment, characterized by rising interest rates and persistent inflation, is dampening consumer spending and impacting demand for electronics. Secondly, geopolitical tensions and trade disputes continue to create uncertainty in the global supply chain, potentially disrupting Amkor’s operations and increasing costs. Finally, increased competition from other packaging and testing providers could put pressure on Amkor's margins.

Demand Trends: A Mixed Picture

The demand picture for semiconductors is complex. While some segments, like automotive and industrial, remain relatively robust, others, such as consumer electronics, have softened considerably. Amkor’s diversification helps mitigate this risk, but it’s crucial to monitor these trends closely. The shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is creating long-term demand for specialized semiconductor packaging, which bodes well for Amkor. However, the overall health of the global economy will ultimately dictate the pace of growth.

Why AMKR Stock is Currently Rated a 'Hold'

Considering the current landscape, a 'hold' rating for AMKR stock appears reasonable. The company's strong market position, diversified customer base, and focus on essential packaging and testing services provide a degree of stability. However, the aforementioned headwinds and uncertain demand trends warrant caution. Investors should closely monitor the following key indicators:

- Macroeconomic Data: Keep an eye on inflation, interest rates, and consumer spending patterns.

- Semiconductor Industry Trends: Track demand in key end markets like automotive, industrial, and consumer electronics.

- Geopolitical Developments: Monitor trade disputes and their potential impact on supply chains.

- Amkor's Financial Performance: Analyze revenue growth, profit margins, and cash flow.

Potential Risks and Opportunities

Risks: A prolonged economic slowdown, further supply chain disruptions, increased competition, and a significant decline in demand for electronics could negatively impact Amkor's performance.

Opportunities: The growing adoption of EVs, the expansion of 5G technology, and the increasing demand for artificial intelligence (AI) are all creating opportunities for Amkor to capitalize on its expertise in semiconductor packaging and testing.

Conclusion: A Cautious Approach

Amkor Technology has demonstrated its ability to weather challenging market conditions. While the recent rebound is encouraging, investors should adopt a cautious approach, recognizing the ongoing uncertainties. A 'hold' rating reflects the balance between the company's strengths and the potential risks. Careful monitoring of the factors outlined above will be essential to making informed investment decisions regarding AMKR stock.